If you’re smart enough to utilise the benefits of salary packaging, then you’d know that the 31st of March is an important date on the financial calendar. This is when the FBT year officially ends and is the cut-off day for that year’s FBT claims. Unlike normal deductions you would make at tax time, fringe benefits are items you can claim through your salary packaging. After this date, your salary packaging cap restarts and a new cap limit is allocated to you.

If your salary packaging is set up as regular payments to your nominated supplier or you have a regular reimbursement, all you need to do is check with your provider that you are maximising your entitlements. If you’re using a salary packaging card or you claim a reimbursement of Meal and Entertainment expenses, we have more than a few ideas on how to make the most of your fringe benefits in the nick of time.

Stake your claims early

To say March is a mad scramble for salary packaging providers is an understatement. That’s because we’re busy trying to process as many claims as possible so they process before the clock ticks over at midnight on the 31st of March. If you try to claim expenses on the day of the 31st, they may not go through the system in time to go towards reaching a zero balance. As a general rule, try to submit your reimbursement claims by mid-March so they definitely contribute to your current annual balance. Remember that unused and unclaimed funds reduce your benefit in the following year.

The No Rollover Myth

A rollover occurs when a benefit balance is not spent or claimed and rolls over from March 31 to April 1. Contrary to popular belief, you won’t lose the money that you had sitting in your unclaimed balance. However, it is still wise to spend it if you can before March 31.

When the FBT year changes, the ‘rolled over’ money is reported as spent in the new FBT year instead of the previous one. This means the ‘rolled over’ amount is treated as part of your new cap limit, so, depending on your industry, your cap entitlement for the new year is reduced. The result is that you may have less tax benefit in the new FBT year.

Not sure what your balance is before March 31? You can look it up in your salary packaging card phone app or call your salary packaging provider for an update.

The FBT spending spree

You have this excess balance, but what can you spend it on before March 31? While you have set up regular salary packaging deductions with your payroll, the deducted amount might arrive too close to the deadline and you have no time to spend it. So, be aware of this and discuss with your provider ways to make additional deductions earlier and relieve the pressure.

An end of FBT spree is your chance to review your salary packaging setup and possibly claim other payments that you have made using your after-tax pay, if they are eligible and you don’t exceed the relevant cap. You simply need to check with your provider and complete your claim form and proof of payment by mid to late March. You need to ensure that you haven’t claimed on these items previously.

What can you claim? It depends on your industry, but as a reminder, the claimable expenses can include:

- Meals & Entertainment

- Private health insurance

- HECS/HELP repayments

- Mortgage repayments

- School fees

- Gym memberships

- Utility bills

- Life insurance

- Holiday accommodation

- Childcare costs

Give your expenses card a workout

Do you have unused funds on your meals and entertainment or salary packaging card and the end of March is around the corner? In the spirit of the return to ‘normal’ after the last couple of years, we encourage you not to be shy. Visit our great regional communities and/or order the steak at dinner and fill up on the expensive petrol at the pump.

When you do use your salary packaging card to try and push towards a zero balance, remember that some vendors, banks and financial institutions may take several days to process transactions. This is yet another reason you shouldn’t wait until the last minute to spend any remaining card balances. Make that dinner reservation, right now.

Will you make the FBT cut-off?

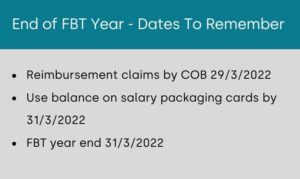

All salary packaging providers have different cut-off dates for when you can make your final expenses claims so check with your provider. If you happen to be with Victoria’s most trusted provider, The Salary Packaging People, see our table below for cut-off dates. We allow as much time as possible to be super helpful.

We’ll answer your questions.

If you need help with your FBT claims, please call to talk to a real person at The Salary Packaging People who can answer your questions. If you’re an employer and not currently happy with your salary packaging services, now is a good time to switch to a truly personable provider. Contact us online or call 03 5229 4200.